Compound interest debt calculator

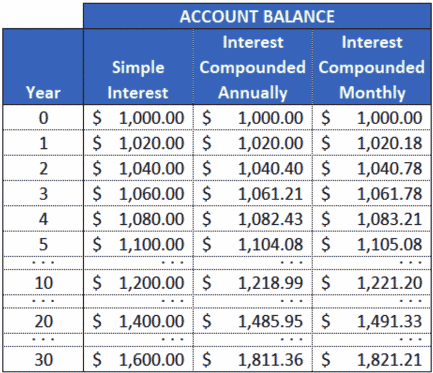

You will also find the detailed steps to create your own Excel compound interest calculator. While compound interest can help your savings grow more quickly than it would with simple interest it can also work against you when youre borrowing money.

How Can I Calculate Compounding Interest On A Loan In Excel

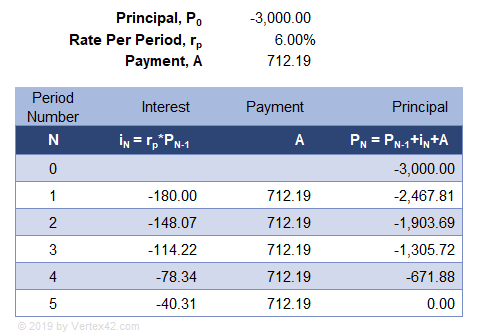

However those who want a deeper understanding of how the calculations work can refer to the formulas below.

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

. Our calculator provides a simple solution to address that difficulty. I have several debts owed to me that I need to track. Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested earning you more interest.

For example one debt from July 01 2015 with a principle of 26727 that is accruing interest of 12 per. Simple compound interest calculator. While the calculation is complicated the bottom line isnt.

Even small deposits to a. Lets say you find two bed. Calculate compound interest savings for savings loans and mortgages without having to create a formula.

A t A 0 1 r n. The more frequently this occurs the sooner your accumulated earnings will generate additional earnings. Its interest payments as a percentage of GDP increased by less than 001 as a result even though public debt increased.

Compound interest is the addition of interest to the principal sum of a loan or deposit or in other words interest on principal plus interest. Interest compounding Earnings on an investments earnings plus previous interest. Compound interest is a powerful concept and it applies to many areas of the investing world.

It consumed 85 of the fiscal year FY 2008 federal budget. In order to understand this better let us take the help of an example. According to Figure 1 this means that type0 the default for the FV functionIf I wanted to deposit 1000 at the beginning of each year for 5 years the FV function in Excel allows me to calculate the result as FV45-10001 where type1Just remember.

Similarly the interest for Sanias second year will be. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. The compound interest calculator online works on the compound interest formula.

A compound interest calculator will help you determine how fast youll save money or spend money depending on your financial situation investments and debts. Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth. Assume that you own a 1000 6 savings bond issued by the US Treasury.

Interest paid in year 1 would be 60 1000 multiplied by 6 60. Treasury savings bonds pay out interest each year based on their interest rate and current value. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

However no guarantee is made to accuracy and the publisher. The interest on the debt was 253 billion in 2008. Note These formulas assume that the deposits payments are made at the end of each compound period.

Understanding how compound interest works will allow you to better understand how debt and interest may affect your ability to comfortably repay an amount of debt over time. Each calculator available for use on this web site and referenced in the following directories - finance calculator retirement calculator mortgage calculator investment calculator savings calculator auto loan calculator credit card calculator or loan calculator - is believed to be accurate. Daily Compound Interest 61051 So you can see that in daily compounding the interest earned is more than annual compounding.

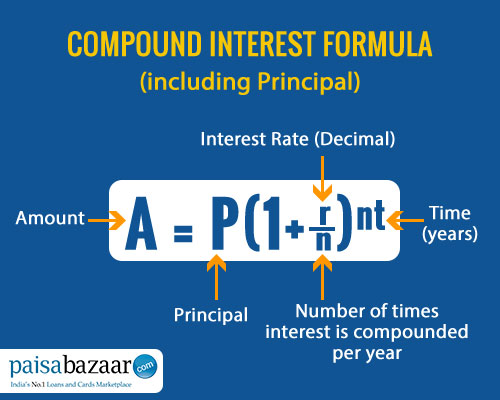

Daily Compound Interest Formula Example 2. The formula for calculating compound interest is A P 1 rn nt. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

As a wise man once said Money makes money. Compound interest can certainly help you increase the amount earned through savings and investments however compound interest can also apply to debt. You can learn more about supercharging your retirement.

It is the result of reinvesting interest or adding it to the loaned capital rather than paying it out or requiring payment from borrower so that interest in the next period is then earned on the principal sum plus previously accumulated interest. You earn interest on top of interest. How Does Compound Interest Affect Debt.

Adjust the lump sum payment regular contribution figures term and annual interest rate. Learning the compound interest formula is key to understanding your savings potential. In terms of debt compound interest can be like a pest problem.

Our compound interest calculator above limits compounding periods to 100 within a year. It declined to 197 billion in 2010 because interest rates fell. This calculator allows you to choose the frequency that your investments interest or income is added to your account.

Simply enter the details of the principal amount interest rate period and compounding frequency to know the interest earned. The calculation of compound interest can involve complicated formulas. You will have to input the principal amount the frequency of compounding your investment tenure and the expected rate of return.

Compound interest investments are investments in assets such as Certificates of deposits equity and debt mutual funds bank FDs. Online Compound Interest Calculator - Use ClearTax compound interest calculator to calculate compound interest earned daily weekly monthly quarterly annually. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan.

A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. For this formula P is the principal amount r is the rate of interest per annum n denotes the number of times in a year the interest gets compounded and t denotes the number of years. The basic formula for compound interest is as follows.

I need to find out what is currently owed on a past due debt that is incurring interest. Many credit cards compound interest daily on average daily balances. At the end of the first year youd have 110 100 in principal 10 in interest.

Interest on the Debt by Year. Credit card debt can be particularly bad as the APR Annual Percentage Rate for many. Calculate interest compounding annually for year one.

For example say you have 100 in a savings account and it earns interest at a 10 rate compounded annually. In this case your interest would be accruing interest. Your money earns interest every day if it compounds daily and then the next days interest is calculated based on THAT total instead of on the principal.

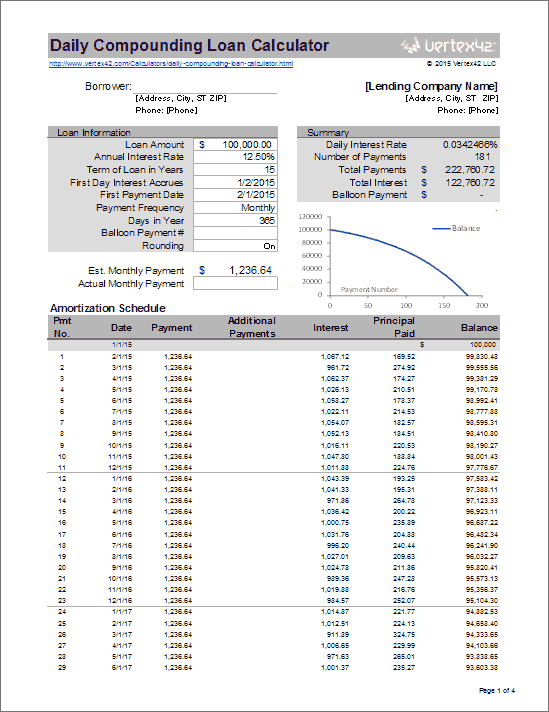

Loan Amortization Calculator

Interest Formula Calculator Examples With Excel Template

Loan Calculator With Interest Sale 56 Off Www Wtashows Com

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Simple Vs Compound Interest Definitions And Calculators Quicken

Simple Interest Loan Calculator How It Works

Compound Interest Calculator For Excel

Free Interest Only Loan Calculator For Excel

How Can I Calculate Compounding Interest On A Loan In Excel

How Can I Calculate Compounding Interest On A Loan In Excel

Simple Loan Calculator

Principal Interest Calculator Sale 54 Off Www Ingeniovirtual Com

Advanced Loan Calculator

Simple Interest Calculator Audit Interest Paid Or Received

Compound Interest Calculator For Excel

Compound Interest Calculator With Formula

Principal Interest Calculator Sale 54 Off Www Ingeniovirtual Com